With great (buying) power, comes great responsibility

Alan Day, Chairman and Founder of State of Flux

The Apple GTAT relationship could have been a brilliant collaboration: for Apple rumoured access to low cost ‘nearly unbreakable’ sapphire screens and for GTAT, it could have been an organisation changing contract propelling them into a leadership position in a market they previously didn’t operate in.

Unfortunately the relationship failure and resulting negative press is turning it into a lose-lose situation for both. The supplier filed for bankruptcy, they lost the opportunity to change the market, make the most of working with Apple not to mention the human impact with many GTAT jobs at risk. Apple doesn’t get the innovation it hoped for, has had their supply chain disrupted and is the subject of negative press surrounding its contracting process, behaviours and possible role in the failure of their supplier.

Without knowing the contractual details and having never been involved with either organisation but reading the press generated from the failed relationship, it does beg the question, how did they get to this place? Apple claims to have “bent over backwards” to support the supplier, and David Squiller, COO of GTAT has voiced his concerns on the alleged contractual negotiation techniques including the possibility of being coerced into signing up to an agreement that ended up looking very different from the deal that was discussed when the companies started their engagement. The term “bait and switch” has been used to describe the tactics employed by Apple.

I suspect like in any relationship breakdown, blame lies with both parties. It is unlikely a company with less dominance in the market would have felt it could change the shape of a deal so radically. Likewise it is incumbent on any supplier to step back from a deal if they feel they are being coerced.

Like most of us, I like Apple’s products and I’m impressed by how they have changed the market. Because of this and almost by default it means I like the company too. I can’t think of an organisation that has such devoted followers. Think of the hype and excitement that occurs every time new products are announced.

Apple has a leadership position in the market place and is a brand that suppliers will want to work with. With revenues last year of$170.9bn and cash reserves of $164.5bn, Apple has the ability to spend large so as an organisation if you are lucky enough to be an Apple supplier there is potentially a big prize in securing a large revenue stream and the kudos that goes with being associated with such a brand.

These two key attributes (brand leadership and spending ability) give Apple a huge amount of power in the market place especially when dealing with suppliers and prospective suppliers. However the mark of a great company is the exercising of that power responsibly. The wise words of Abraham Lincoln come to mind: “Nearly all men can stand adversity, but if you want to test a man's character (or in this case an organisations), give him power.

Most of us like exacting customers, they push us to raise our game, ensure our quality is top notch, and make sure we are thinking of things from different perspectives. Apple is famous for their exacting requirements and attention to detail. Rightly they refuse to compromise in terms of quality and are demanding in all aspects of their requirements. It would be wrong to single Apple out in this regard but fastidiousness combined with brand dominance and spending power can create cultural and behavioural problems if not recognised and addressed. There is a fine line between being exacting and exploiting the relationship.

The concept of customer of choice has been discussed for some time now and the benefits have been validated in our 2014 SRM report. It is evident from both buy and sell side feedback that suppliers give preferential treatment and benefits to customers they regard as their customers of choice.

This chart illustrates the type of benefits that the buy-side receives. You will note that that a much higher proportion of companies with a more developed and mature approach to supplier relationship management (i.e leaders) receive customer of choice benefits.

-power,-comes-great-responsibil/Customer-of-choice-benefits.png)

This pattern has developed over the six years we have been conducting this global research in to supplier relationship management (SRM) and over this time we have identified three reasons why an organisation would be a ‘customer of choice’.

-

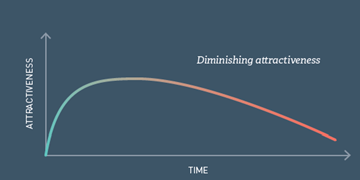

Key client acquisition and brand association. Suppliers would like to align to your brand or have your brand on their corporate CV. However, once the customer contract has been won and the corporate CV enhanced customer association no-longer drives customer of choice benefits in the same way. Therefore the attractiveness of this attribute diminishes over time.

-

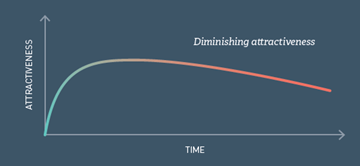

Revenue, profit and superior ‘wallet share’. Suppliers can either earn good revenue or margin on your account. Inadequate financial outcomes are a de-motivator but when financial measures reach a desired level they no longer drive customer of choice benefits to the same extent.

Revenue, profit and superior ‘wallet share’. Suppliers can either earn good revenue or margin on your account. Inadequate financial outcomes are a de-motivator but when financial measures reach a desired level they no longer drive customer of choice benefits to the same extent.

-

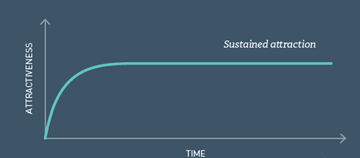

Customer attributes – different factors and behaviours that signal the supplier as a ‘trusted partner’. Suppliers find you easy to work with and there is mutual respect. Ease of business, collaboration, trust and partnership are all behaviours that will drive sustained customer of choice benefits.

Customer attributes – different factors and behaviours that signal the supplier as a ‘trusted partner’. Suppliers find you easy to work with and there is mutual respect. Ease of business, collaboration, trust and partnership are all behaviours that will drive sustained customer of choice benefits.

It could be that Apple along with many other large and dominant companies have not focused on the third element or not focused on it enough. Many companies struggle with the change in market dynamics that has led to customer of choice being more of an imperative. This seems to be particularly a challenge in larger companies where the old adage “the customer is always right” is taken literally. I don’t think in most cases this is a conscious decision, but more a product of a culture that has propagated the ‘master and servant’ view of supplier relationships.

Suppliers need to have a ‘safe’ environment to raise concerns, challenge ideas, suggest new ways of working and make mistakes (as long as they don’t make the same mistakes twice). Fear and blame should have no place in modern supplier relationships. Through our studies and working with clients to develop SRM we have explored the key attributes of good supplier relationships that are productive and well aligned. When supplier relationships exhibit these kinds of attributes, the buy side in the relationship is far more likely to be customer of choice. Good buyer-supplier relationships can be characterised by the following attributes:

This is especially important when the balance of power is so skewed towards one party. The lesson that other organisations can learn from this situation is that brand and spending power are not enough on their own. You need to put in place the third element that consists of people, process and technology to create the right culture and behaviours to ensure that you are working together with your suppliers to maximise the value for both parties.

To borrow from Voltaire “with great (buying) power, comes great responsibility” and this is especially true in a supplier relationship context.

About State of Flux

On behalf of some of the world’s leading organisations, State of Flux supports the development of SRM programmes, conducts voice of the supplier research, runs 360º feedback diagnostics, facilitates joint account planning, provides SRM technology and runs SRM training. Please contact us on +44 (0)2078 420 600 or email us at enquiries@stateofflux.co.uk to talk about these activities and how we can support your SRM programme.