FOREWORD

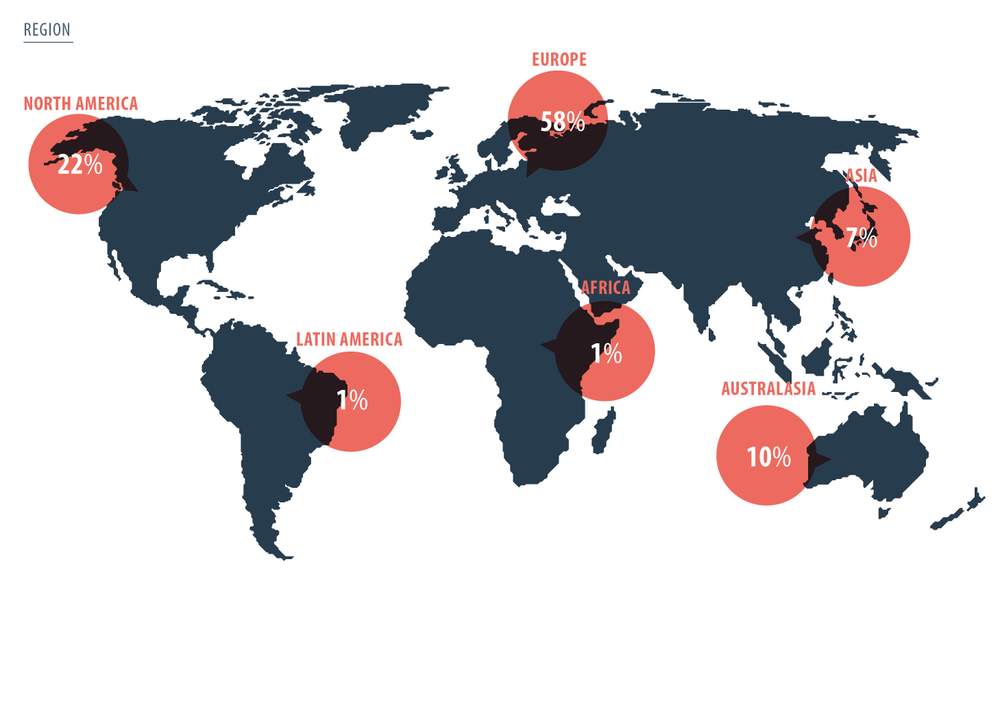

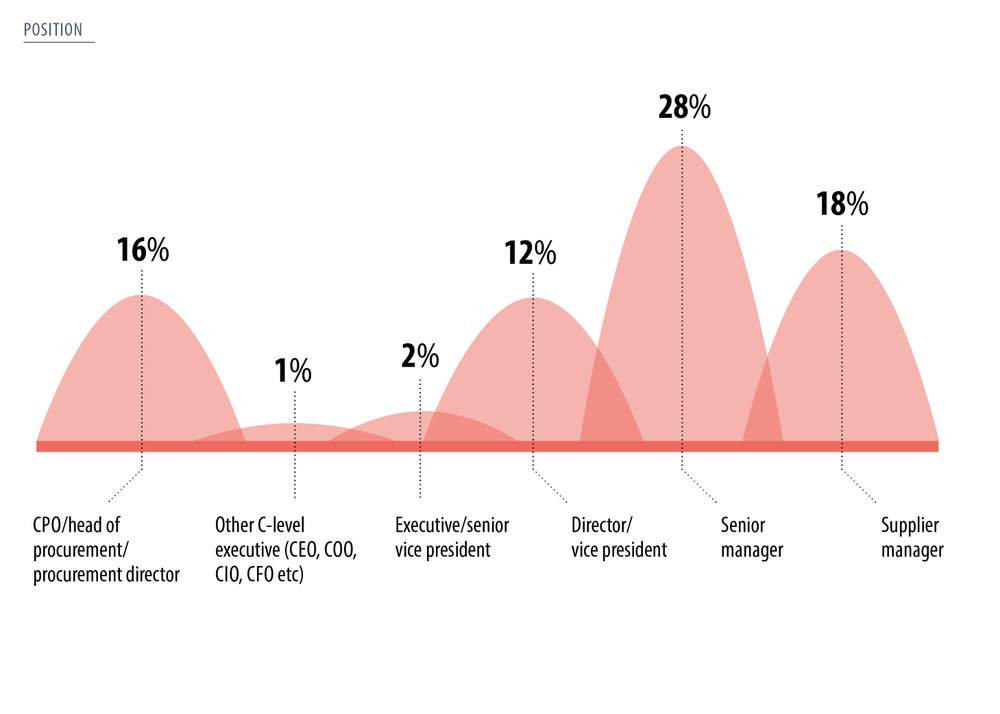

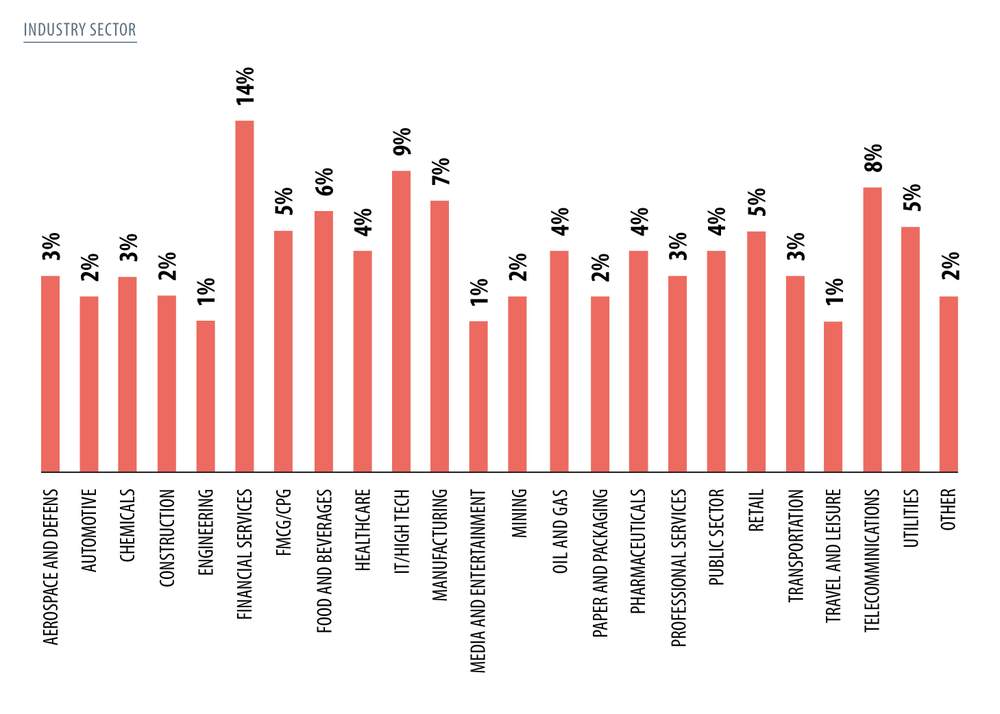

Welcome to the 2015 Global SRM Research Report. Thank you to everyone who has supported us this year. The research is now in its seventh year, and this time more than 360 companies have participated globally. Over the course of the past seven years we have seen input from more than 1,200 companies, giving us over 500,000 data points on supplier relationship management (SRM).

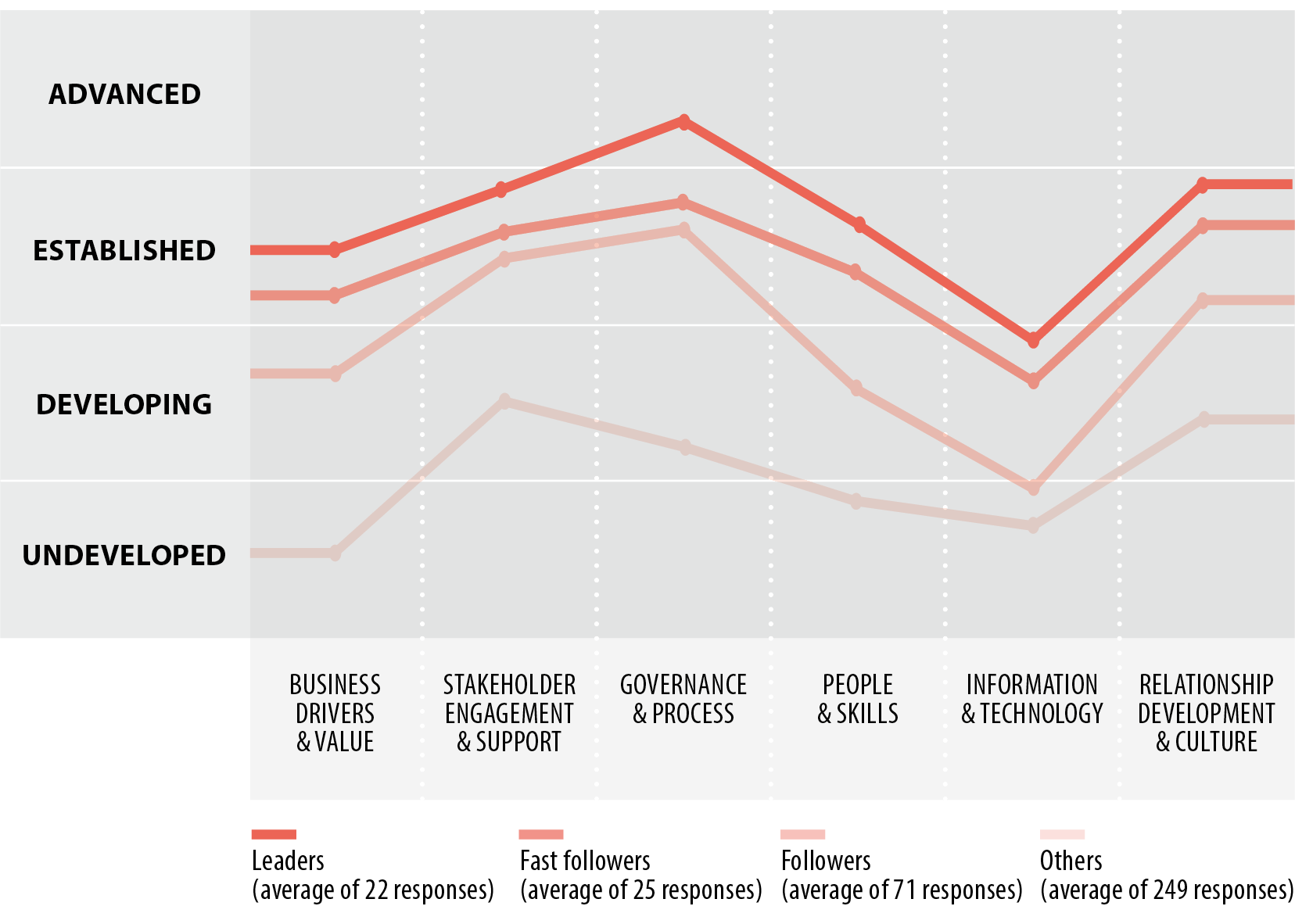

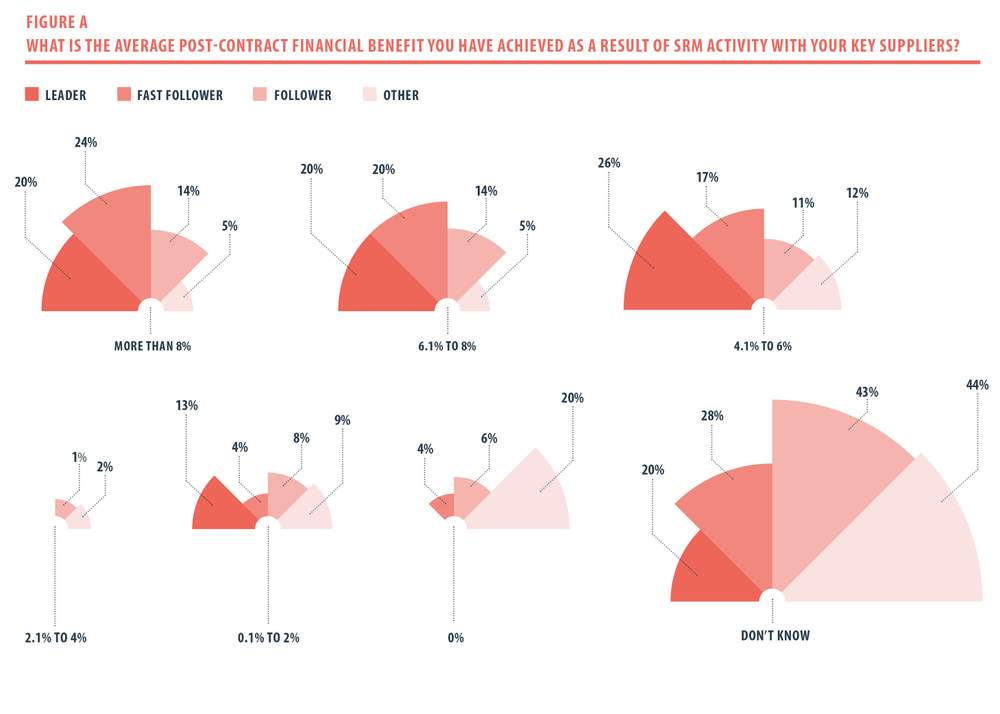

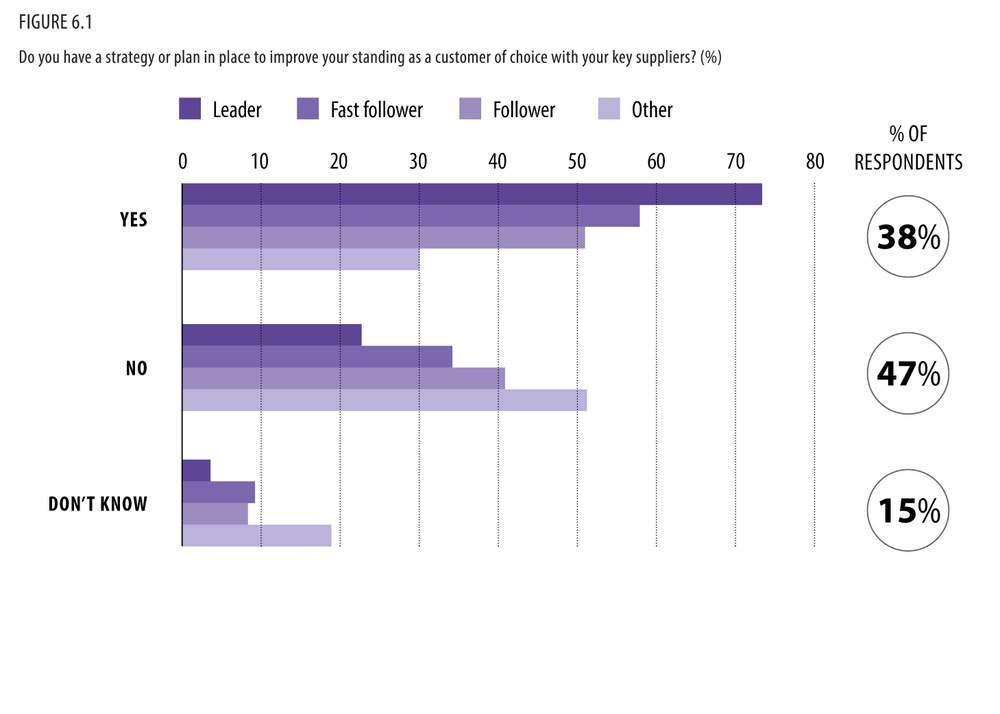

You may notice that our report has taken on a different look this year. While our research has been as comprehensive as ever, we have decided to focus on the business opportunity that SRM presents and how this needs to be moved up to the senior executive agenda. Companies that have a structured and well-supported approach to SRM are reaping more direct financial benefits, as well as broader commercial gains, such as access to innovation, improved speed to market and greater profitability. The gap in value derived from SRM continues to increase between companies fully committed to and investing in SRM (leaders and fast followers), those who are at an earlier stage in their journey (followers) and, most certainly, those who approach it in a piecemeal way (others).

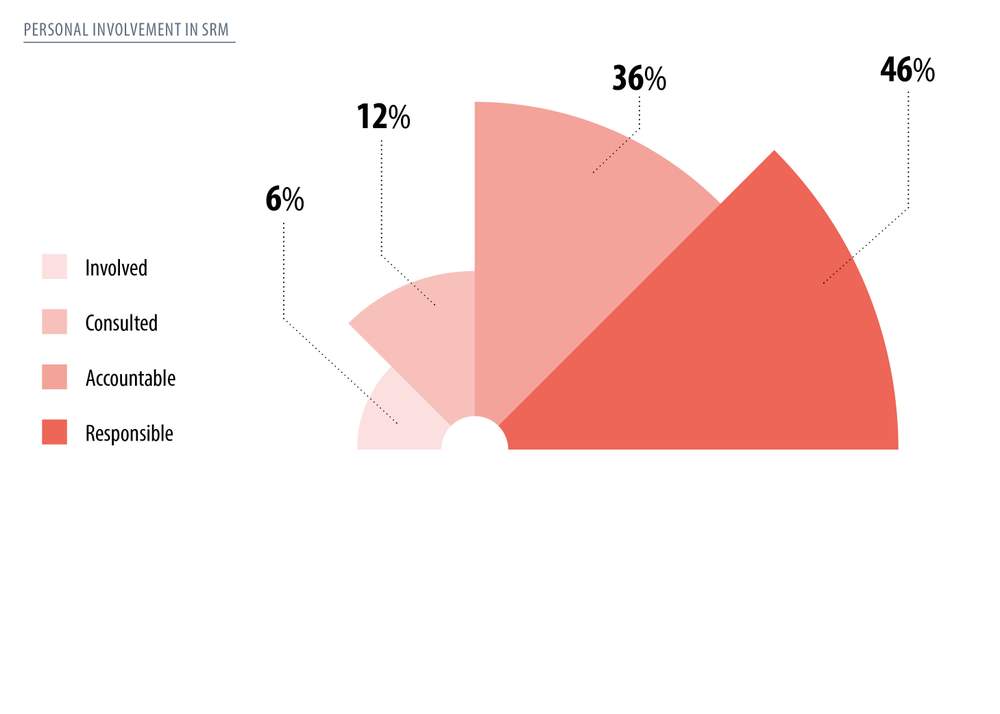

Our research and direct engagement with clients make us sure that realising tangible value requires the whole business to embrace SRM. It needs to be a business change programme rather than a procurement initiative, and it needs full engagement and support from the senior executive level down. This report is written with senior executive or C-suite readers in mind, whose support and engagement is critical to SRM achieving its full potential for businesses. We hope the evidence within convinces you that supplier relationships are a key lever to achieving the business objectives of growth, profitability and increased shareholder value.

As for how you deliver this, please contact us or we have provided many tools, tips, articles and case studies highlighting best practice in our 2013 and 2014 SRM reports. These are available to download at www.stateofflux.co.uk (under ‘Reports and publications’).

I hope you enjoy reading the report and, as always, find it stimulating and a valuable source of information.

Alan Day

Chairman and founder

State of Flux

INTRODUCTION

SRM is a business-critical issue. Our seven years of research in this area have demonstrated that companies that get this right generate higher profits, innovate more effectively and

are better able to manage risk. It is hard to imagine a more commercially relevant set of issues, all of which we discuss in more detail later in this report.

All the evidence suggests that the role of suppliers will only become more important in the future. We can see that the nature of business is changing, with many companies becoming both flatter and more reliant on third parties to deliver everything from customer support through to research and development as well as more traditional products and services. In other words, businesses are putting more and more of their brands’ reputations into the hands of other companies. In such a scenario, a business can only be as good as its worst supplier.

This is why business leaders – chief executives, managing directors, executive chairmen – need to take notice of SRM. Procurement functions can and should offer support and advice, but at its heart SRM is a strategic issue that requires senior strategic leadership.

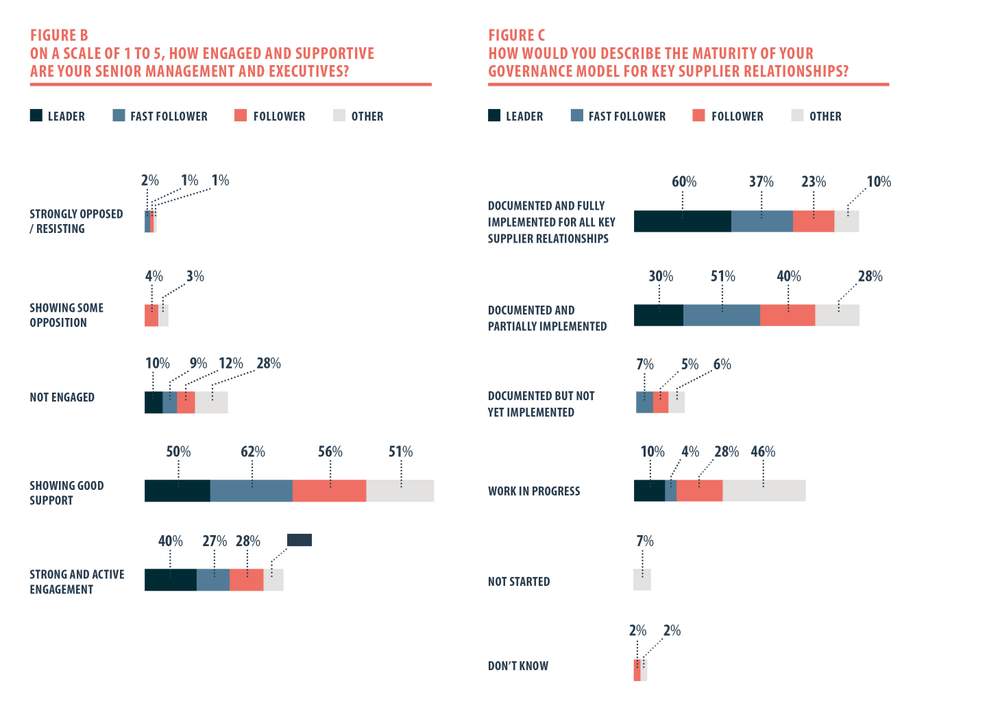

In fact, this year’s research shows a direct correlation between companies that are leading the way in this area and strong senior backing of SRM, with 46% of leading companies saying that SRM has the support of their top executives. On the other hand, this is true of only 21% of all organisations in this year’s survey, while the proportion that say their leaders are not engaged has risen, now sitting at well over a fifth.

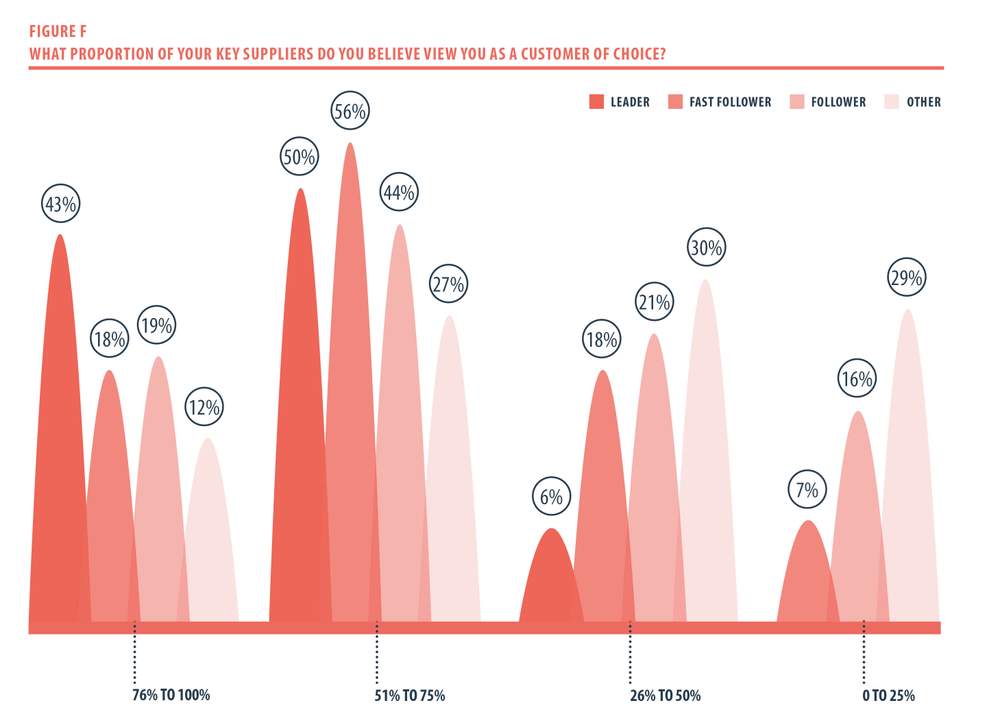

Why does this matter? Because organisations that want to make a real difference with SRM – and that should be any organisation that wants to maintain its competitive edge – need to be led by people who understand its importance. That means recognising that changing business dynamics are giving suppliers more power and choice about who they partner with, and how. It means in turn recognising that becoming a key supplier’s customer of choice will bring access to a range of benefits, from price advantages to innovation – and that failing to do so will mean such benefits accruing to competitors instead.

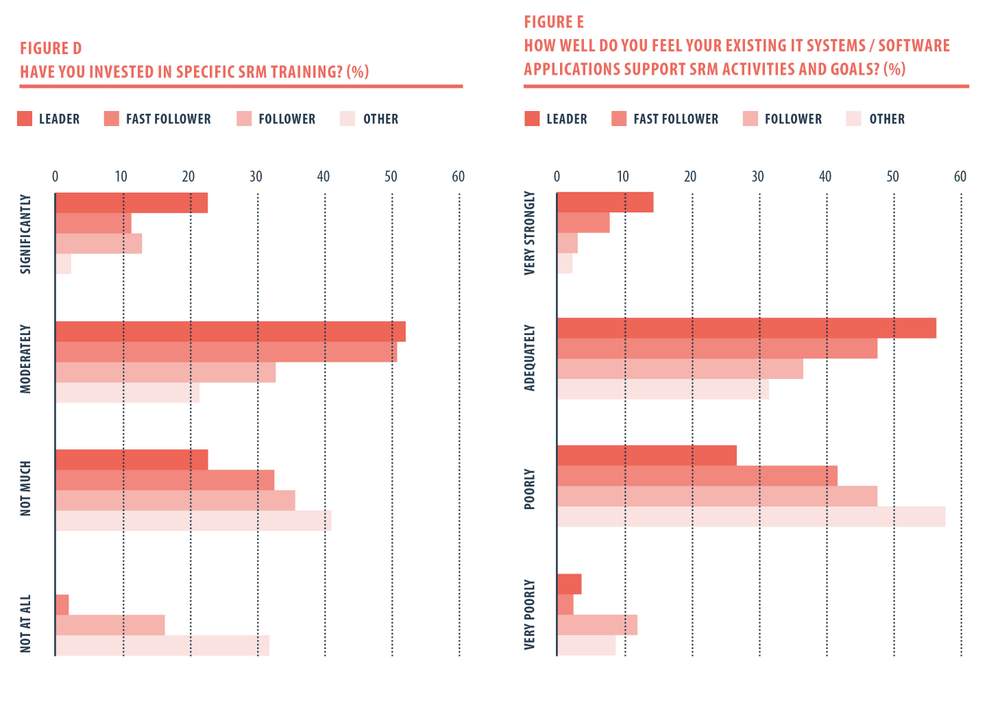

This understanding must be paired with a board-level commitment to investing in the technology and training that underpin successful SRM and to creating an organisational culture in which all employees understand the part that they play in SRM, and the part that it can play in meeting their own needs. Novartis’s Chris Holmes offers a particularly good example of this on page 17.

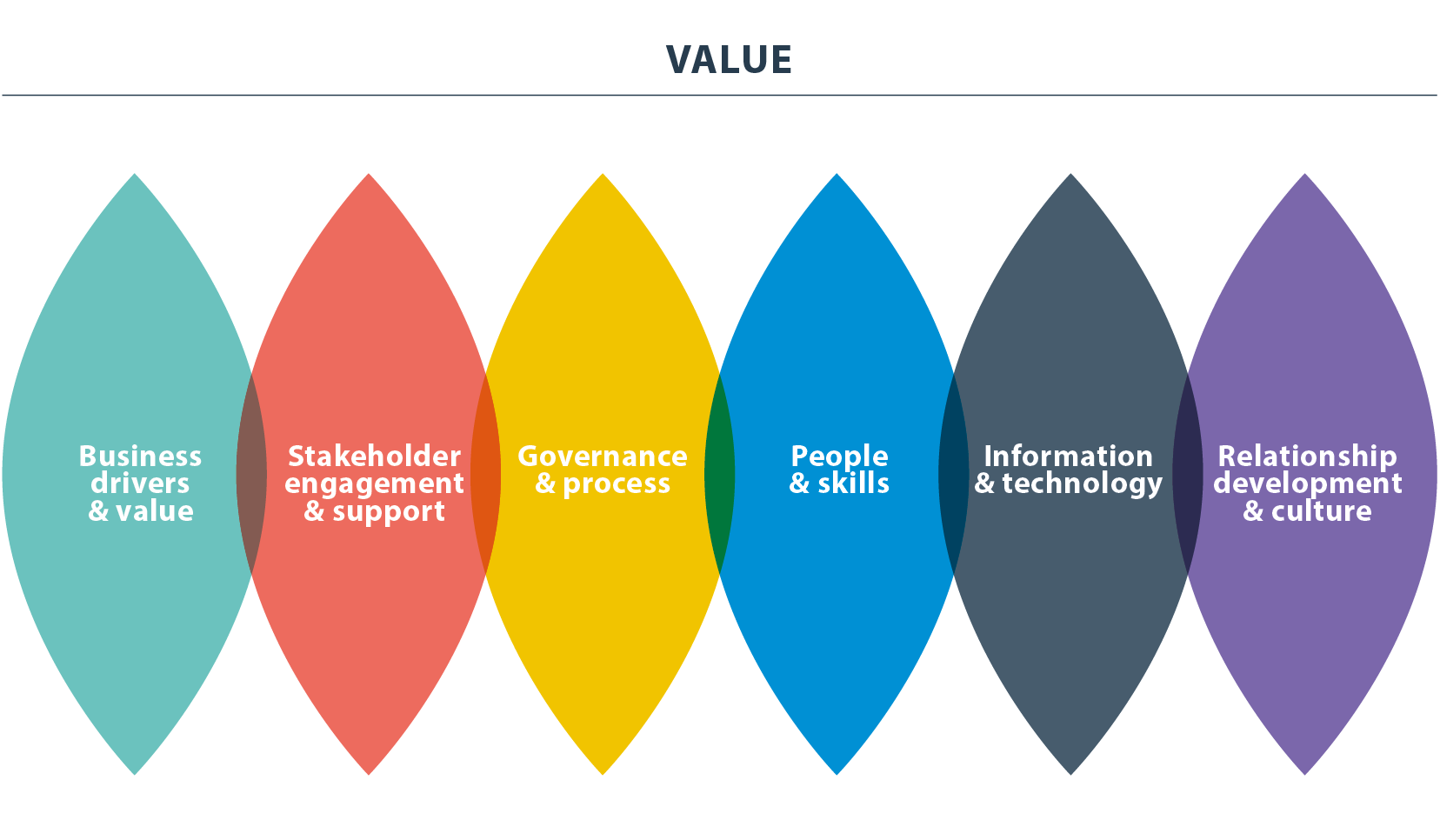

As in previous years, we have asked questions and analysed answers around the six pillars of SRM:

-

Business drivers and value: this covers the SRM value proposition – both the bottom-line benefits, such as the cost reductions reported by 60% of respondents,

as well as less tangible advantages such as innovation and preferential access to scarce resources. -

Stakeholder engagement and support: this is often thought of as something that concerns external stakeholders but, as our research around the low levels of senior executive engagement indicates, it is just as important to consider internal stakeholders.

-

Governance and process: 80% of respondents say that they do not have robust risk management in place for more than three quarters of their suppliers, despite the very real chance of reputational, financial and even criminal damage when governance fails.

-

People and skills: responses make clear that training people in communication and other skills needed to deliver effective SRM is not a organisational priority for many – 40% have not spent much on SRM-specific training, while more than a quarter have invested nothing at all.

-

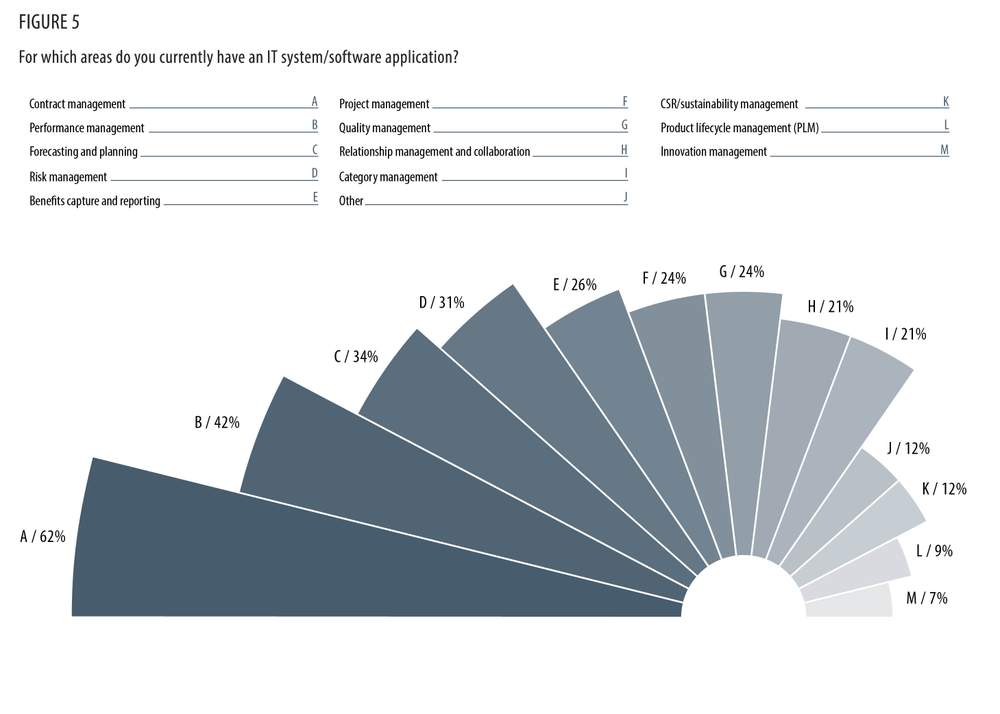

Information and technology: this has the potential to make every other pillar easier to manage in a more effective manner.

-

Relationship development and culture: on this last pillar more than 90% of respondents cite good cultural alignment as being important or very important to successful supplier relationships.

As you read through these findings we ask you to remember that all six pillars are interlinked. It is only with the commitment and support of its leadership team that any organisation will be able to make the changes needed to embed SRM into its culture in a way that makes it the responsibility of every employee – not simply those that work in a procurement or supply role. This does not mean that chief executives have to become de facto chief procurement officers – far from it. It simply means they must recognise that the strategies they develop and the examples they set have a crucial role to play in shaping SRM, and that the shape of SRM has an equally important role in the success of the organisation as a whole.

BUILDING PROFITABLE RELATIONSHIPS

Our research indicates that good SRM contributes to between 30 and 70% of a company’s gross profit.

Where does this figure come from? For the past 25 years we have studied the relationship between major manufacturing companies and their tier-one suppliers – first in the automotive industry, and then in another 17 sectors. From this research we developed the Working Relationships Index®, which shows that the more collaborative the relationship between supplier and customer, the greater the supplier’s contribution to the company’s profitability. In the auto industry this contribution is, on average, around 70% of gross profit. In other sectors, where customers spend a smaller proportion of their revenue on suppliers, the supplier impact can drop to 30% – still a substantial contribution to the firm’s profit.

This contribution comes in two ways. The first is that better relationships give suppliers the assurance that they will continue to supply the company in the future, which results in suppliers being willing to offer greater price concessions in the present.

The second factor relates to non-price benefits. For example, the more collaborative the relationships, the more willing are suppliers to share new technology without the assurance of a purchase order or to invest in innovation in anticipation of future business. In addition, when the customer needs support, suppliers will give this ‘customer of choice’ A-team support (rather than B-team), and will invariably provide more support than is contractually required.

Together these non-price activities allow customers to be more efficient and effective in their operations and to get products to market faster than their competitors. At the same time, the arrangement also benefits suppliers: our latest research suggests that collaborative relationships improve not only customer profits, but supplier profits as well. The reason

for this joint benefit is that neither side has to waste time on nonsense such as the adversarial accusations associated with non-trusting relationships, which are much more difficult to maintain. With a collaborative, trusting relationship things run more smoothly and, if a problem does arise, it can be resolved in a quick and straightforward manner.

So what does it take to become a customer of choice? First, get the foundation in place. Customers need to follow good business practices that are conducive to suppliers wanting to work with them: pay invoices on time, resolve any payment issues in a timely manner, and have purchasing personnel who are willing to work to develop good supplier relationships. Second, build on this foundation with relationship initiatives that benefit all involved. For instance, help suppliers reduce their costs by sharing information with them early in the product development cycle, and minimise any conflict between purchasing and engineering or other functions in the business.

Good supplier relationship management contributes to between 30–70 per cent of a company’s gross profit

Finally, it is worth noting that companies do not need to build great relationships with all their suppliers. Our advice is that firms should concentrate their attention on those suppliers whose role is critical to their own success. However, others, even those suppliers with whom dealings are transactional, should be treated in a trusting manner. The bottom line is that any company that wants to improve its profitability would be well advised to put effort into working with its suppliers in a manner that is commensurate with the supplier’s importance.

Dr Henke is president of consultancy Planning Perspectives, Inc, a professor of marketing in the School of Business Administration at Oakland University in Rochester, Michigan, and a research fellow at the Center for Supply Chain Management, Rutgers University, New Brunswick, New Jersey.

SUPPLIER VIEW

On average, State of Flux conducts one or two Voice of the Supplier (VoS) studies for clients every month – that’s more than 1,200 different suppliers in the past two years. These give us a unique insight into industries as varied as the automotive, financial services and food and drink industries. From this work we have identified a number of consistent themes that exist across sectors and that send a powerful message to business leaders.

It is also worth pointing out that many leading companies conduct their VoS studies to increase mutual understanding and ensure that they are remaining customers of choice. Such VoS studies have three key uses: they enable the company to assess whether it is operating in a way that gets the best out of its relationships with suppliers and whether there are any gaps that threaten its standing as a customer of choice; they can add suppliers’ perspectives to any business case being made for change or investment; and they can position the customer as one that is prepared to listen and engage.

This is suppliers’ biggest complaint, with 58% reporting that client-led delays in making decisions are a major barrier to successful implementation of innovation and change. Things do not seem to get better once the decision is finally taken, with 55% reporting that bureaucratic approval and sign-off processes cause problems too.

A supplier will only want to invest in innovation to support its client if it is confident that the client is actually interested in its ideas. If not, it makes more sense to find someone else who is. The problem here, say 53% of suppliers, is that many organisations lack the internal alignment needed to know this themselves.

Suppliers want to work in partnership with their most important customers by exploring joint investment opportunities and ways to share risk and reward. This approach offers companies significant opportunities to secure a commercial advantage over their competitors. However, 53% of suppliers say that their clients do not want to talk about sharing risk and reward, while 42% rule out joint investment discussions.

Effective management of CSR risk shapes the reputation of both organisations and the chief executives that lead them. Despite this, a large number of companies fail to engage with their suppliers on this issue, with 38% of suppliers saying that their clients are not receptive to ideas that promote CSR improvements.

Some of the most powerful, market-changing innovations in recent years have come from people and companies thinking outside traditional markets and models, from Uber’s taxi hire to Spotify’s music streaming service. Despite this, too many companies are unwilling to look at any ideas beyond their rigidly defined list of priorities, say 33% of suppliers.

Slow decision-making is suppliers’ biggest complaint, with 58 per cent reporting that client-led delays are a major barrier to innovation

CASE STUDY

Innovation is at the core of what Novartis does. This global company, headquartered in Switzerland, builds innovation into all aspects of its business, from scientific discovery right through to the efficiency of its manufacturing processes. Novartis also collaborates closely with external partners to drive innovation, says Chris Holmes, the company’s head of global procurement strategy and transformation.

“We pride ourselves on our strong research and development capabilities, supported by robust processes along the entire value chain. But at the same time we recognise there is a huge amount of external experience, talent and expertise that we can draw on for the benefit of our customers.”

Involving diverse parties allows us to secure the best and brightest brains to work challenges into innovative solutions

While the focus on innovation has been part of the company’s ethos for some time, SRM at Novartis has only really come into its own in the past five years or so, Holmes says. “It began with a procurement transformation project in 2011–12 that looked at how the procurement function could contribute to innovation in collaboration with our supplier base. That was when we introduced the SRM concept, which we call supplier performance and innovation (SP&I).” This name was chosen over SRM to emphasise the initiative’s focus on outcomes, Holmes explains. “We want to improve performance of the total relationship and to drive innovation together for the benefit of both parties.”

Novartis now has a number of SP&I managers who work alongside the firm’s category teams to ensure that procurement, the business and suppliers are collaborating effectively. “They focus on supplier segmentation and on the areas where there are opportunities to work more closely with our most important suppliers – the ones with game-changing potential,” Holmes says. “They look for ways to add value beyond the contracts in these key relationships.”

One example that neatly illustrates how the procurement function is connecting its key suppliers to the business comes through the Innovation Factory. This Novartis approach was developed to leverage a 360-degree viewpoint from in-house and external experts to address patient and brand challenges. “Involving diverse parties allows us to secure the best and brightest brains to work challenges into innovative solutions,” Holmes explains.

Suppliers benefit from the SP&I approach through improved understanding of the company, which in turn helps them to see new opportunities to grow their own businesses while at the same time supporting achievement of Novartis goals. “A relationship needs to go both ways. There has to be a balance of benefits.”

Getting to this point required a clear strategy and sponsorship from the highest levels. But it was having the right people with the right mentality across the business – not just in procurement – that was key, says Holmes. It also required flexibility and openness to change, he adds. “You need a good process as an anchor, but you shouldn’t get hung up on it. You need to be willing to burn it down and start again as often as you need to.”

CONSULTING.

TRAINING.

TECHNOLOGY.

Our services include:

• Supplier management

• Category management and strategic sourcing

• Contract lifecycle management

• Training and development

• Statess SRM technology

Seven years of global research into supplier management gives us a deep understanding of our clients’ needs and underpins our consulting, training and technology services. Call us to discuss how we can help you deliver savings, reduce risks and drive value without destroying valuable supplier relationships.

CALL US ON +44 (0)2078 420 600 OR

EMAIL US AT ENQUIRIES@STATEOFFLUX.CO.UK

WWW.STATEOFFLUX.CO.UK

WWW.STATESS.COM

BOARD-LEVEL PERSPECTIVE

SUPPLIER RELATIONSHIPS: A KEY TOOL

Business leaders are facing a new industrial revolution. Technological innovation is changing the world at a speed not seen in generations and in ways that have the potential to entirely reshape business as we know it. Chief executives must ensure that they know exactly what tools they have at their disposal to compete effectively now and in the future.

One of the most powerful tools available to businesses – yet one that is not always visible at board level – is a strong relationship with their key suppliers. My experience turning around The Monarch Group between 2011 and 2013 showed me that companies have far more to gain from creating a true partnership with suppliers than from engaging in an old-style master–servant relationship. In our case it allowed us to take out £52 million of annualised cost, representing around 12% of the discretionary cost base, over just two years. This was not achieved in one fell swoop but through thousands of incremental improvements that were achieved by us working in partnership with our suppliers. It also meant recruiting skills into the group that resonated with this approach.

Working in a spirit of partnership means embracing the idea that both parties will grow their businesses together. It creates an atmosphere of goodwill that makes it much easier to adopt the flexibility that is becoming ever more critical to business success. It makes it easier, for instance, to vary a contract whether in response to changing market conditions or the wish to innovate.

Creating this sort of partnership approach takes leadership. SRM is not something that can be parcelled up, handed to the procurement department and then ignored by everyone else. It must be embedded in the culture and values of the company. As it is the senior team that shapes that culture, it must be the senior team that leads the way on promoting SRM. If there are internal barriers preventing this, it is the senior team that should constructively break them down.

Any chief executives that are struggling to grasp why they should do this, or exactly what value SRM brings to their business, should take responsibility for doing whatever is needed to gain that understanding. In my experience the main reason why SRM is not given the C-suite attention it deserves is that time-constrained senior executives fear getting into the detail of supplier arrangements. This is easily overcome thanks to technology that now makes it much more straightforward for senior executives to access supplier information in a succinct and relevant way.

With this information, supported by strong and genuine supplier partnerships, business leaders will be able to position themselves and their companies to grasp the multitude

of opportunities that the innovation revolution is bringing with it.

Without it, they should prepare to see their company struggle to thrive, or even to survive.

Iain Rawlinson is the managing partner at Rawlinson Partners Limited and chairman or director of a number of organisations. He was executive chairman of The Monarch Group from 2009 to 2014.

PARTNERS

ABOUT STATE OF FLUX

State of Flux is a global procurement and supply chain consultancy. We specialise in consulting, training and technology in supplier management, strategic sourcing, category management and contract lifecycle management.

Founded in 2004 by Alan Day, State of Flux is headquartered in London, UK and currently has offices across Europe and Asia Pacific, with plans for US offices. Our clients are large global and high-growth companies across many industry sectors, including financial services, oil and gas, FMCG and technology. Seven years of global research into supplier management gives us a deep understanding of our clients’ needs and underpins our consulting, training and technology services. Our services improve clients’ procurement capabilities and deliver sustainable value.

Call us on +44 (0) 20 7842 0600

or email us at enquiries@stateofflux.co.uk

www.stateofflux.co.uk

www.statess.com

State of Flux Limited has asserted the right under the Copyright, Designs and Patents Act 1988 to be identified as the author of this work.

All rights are reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means – electronic, mechanical, photocopying, recording or otherwise – without the prior permission of the copyright owner.

The information contained within this report is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received, or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

Publication date: November 2015

Publication name: 2015 Global SRM Research Report – The Business of Supplier Relationships