Supplier rewards - are you rewarding acts of bravery or performance?

In part one we looked at the key questions you should ask before setting up a supplier awards programme. Are you looking to reward ‘acts of bravery’? Continuous or sustained performance? Or both? In part two we look at how you measure ‘real’ supplier performance and find your award candidates.

Once you have decided the focus of your awards programme, we need to look at how this will be measured, managed and monitored. For the purpose of this article we are going to assume that you have followed our advice and are measuring both performance metrics (KPI’s and SLA’s) as well as relationship-based factors.

Performance metrics

Our annual SRM research reveals a number of challenges on performance management; with only 20% of organisations having robust performance management in place with their strategic suppliers. The most common of these challenges are the lack of alignment between the performance metrics, the contract, the business requirement and the relationship. We’ve written previously about the need to get a ‘clear line of site’ between each of these elements.

In reality, most organisations suffer from a disconnect between what the business really wants, how this is articulated in the contract, the performance metrics developed and the relationship.

If we believe that the adage of ‘what gets measured gets done’ then selecting SLAs and KPIs that reflect strategic and operational objectives, are agreed with the business, negotiated and embedded as contractual obligations and linked to relationship management is key.

In this way your supplier awards that recognise performance will resonate with the business. The reason for this is because you haven’t just recognised performance against a set of KPIs but have recognised performance that is making a direct contribution to the company’s strategic objectives.

How do you set up a KPI?

It might help to review the following good practice that goes beyond the usual SMART model

-

Specific – clear and focused to avoid misinterpretation or ambiguity;

-

Measurable – can be quantified/measured and may be either quantitative or qualitative;

-

Agreed – all contributors agree and share responsibility;

-

Relevant to and consistent with your company’s vision, strategy and objectives;

-

Timely – achievable within the given timeframe;

-

Focused - on strategic value rather than non-critical outcomes - selection of the wrong KPI can result in counterproductive behaviour and sub optimised outcomes;

-

Realistic – fits into normal constraints and is cost effective;

-

Attainable – requires targets to be set that are observable, achievable, reasonable and

-

Weighted – importance relative to other KPIs is recognised

-

Normalised – can be viewed as a percentage value against target to allow comparisons across different KPIs

-

Predictive – can identify trends that indicate potential failure before it happens;

-

Reported – regular reports are made available to all stakeholders and contributors;

-

Governed – accountability and responsibility is defined and understood;

-

Resourced – the KPI measurement is cost effective and adequately resourced throughout its lifetime;

-

Assessed – business requirements and other factors change over time so KPIs need to be regularly reviewed to ensure they remain relevant.

To introduce supplier awards that recognise performance across different suppliers; product or service lines; multiple business units or regions requires a way of ‘normalising’ KPIs in order to make fair and unbiased comparisons. This is where turning KPIs in to a percentage value against a target is required.

All of this, whilst complex, is achievable when dealing with a single KPI, however some organisations and supplier relationships may have multiple KPIs within their balanced scorecard and in turn, hundreds of supplier relationships that fall into the ‘performance management’ tier or above of their segmentation model. As the volume of data grows it become more important to collect and process the data efficiently. The time that adds value to KPI analysis is looking at and interpreting the data, not collecting it. This is where automation becomes a vital tool to collect and report KPIs.

Performance management whether based on qualitative or quantitative data needs to be a formal and repeatable process.

Relationship-based metrics

Relationships can be recognised both formally and informally (see our model from Part 1) with the formal aspects of a relationship being measured via a 360° review, and informally by recognising ‘acts of bravery’ when the supplier goes out of their way to support or help.

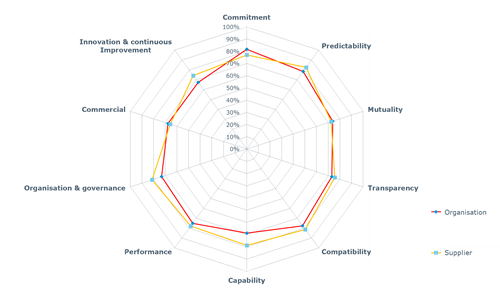

For a formal 360° review State of Flux uses a trust and control model, where trust covers attributes such as commitment, predictability, mutuality, transparency, compatibility, while control covers capability, performance, organisation & governance, commercial, innovation & continuous improvement. Representatives from both parties are asked to provide their feedback on these attributes and you typically get a ‘spider graph’ like the one below.

The output of the 360° review is usually used for input into a joint account planning session where focus is on how to either close the gaps where both parties have a widely different view of the relationship, or to improve those areas both parties feel aren’t performing well. A 360° does something that has traditionally been considered difficult and that is to create measured data (metrics) and a baseline for a relationship against which actionable improvements can be identified.

If you intend to recognise what we have described here as ‘acts of bravery’ in a public forum then you will need to create at least some formality. These acts will need to be quantified and validated if they are not to be criticised as potentially unfair.

In most instances, the supplier will be doing a good deed to help fix a challenge/issue we ourselves or a different supplier has created. In this instance having a process to document, track and communicate the good deed is important. Most organisations informal communications network works well when it is news about poor performance or the supplier has slipped up (how often does someone remember that the supplier let us down years ago?), yet the positive news network requires communications effort.

Ultimately, the best way to continue to manage and develop suppliers is to measure both performance and relationship aspects and use a combination of these scores to work out which ones to recognise via supplier awards. We think both are equally important, you can’t have a good working relationship with an organisation that performs these tasks well but no one likes working with or vice versa.

It’s important to develop formal performance measures that are aligned to the contract and the relationship. Equally it is important to measure the relationship aspects including having the ability to document, track and communicate good deeds and other positive supplier news.

Next time, in part 3, we will look at how you would design and run a supplier awards event to get the most out of the day.

Download the 2016 SRM report